For founders and executives, calculating the budget for a FinTech app is among the initial obstacles that they have to deal with, along with being one of the most difficult issues to give a precise answer to. FinTech app development costs are however largely influenced by the financial logic, regulatory exposure, and infrastructure behind the product rather than the user interface complexity. This is due to the fact that the technology decisions made in the FinTech industry have direct impacts on compliance, security, and customer trust. Thus, the situation is very different for digital products.

In the case of real-world projects, the price of developing a FinTech app normally amounts to a minimum of $50,000 and can go up to $500,000 or more. The wide gap between the two values mentioned is influenced by the types of such products, the markets they are aimed at, and the objectives for future scalability. At times, the understanding of these factors needs an experienced hand that has worked with regulated architectures and financial workflows, hence the reason for a lot of teams partnering with fintech solutions software development services providers. These are the ones who help in technical road-mapping and realistic budgeting before the major expenditures are made.

Why FinTech App Costs Vary So Widely

One of the main factors that cause large differences in FinTech development costs is the fact that not all FinTech products address the same class of problems. A simple expense tracking application that collects and summarizes user transactions from open banking APIs is a totally different case from a loan platform that does the necessary credit assessment for the borrowers or a digital bank that accepts deposits from clients. As the product gets closer to dealing with real money flows, regulated data, or financial risk, the base cost just keeps getting higher.

Chime is a good market example. The company, before scaling up to millions of customers, spent a lot on backend systems, banking partnerships, and compliance procedures. This early investment led to an increase in initial development costs and delayed the emergence of new features, but it allowed Chime to expand its customer base gradually and reliably without having to deal with the problem of regulatory and infrastructure bottlenecks repeatedly. The situation is different with some other FinTechs, which tend to struggle because by the time they get to the growth level, they still have not made the investments necessary to build up their infrastructure.

The Impact of Regulation and Compliance on Development Cost

Regulatory compliance is frequently the most underrated expense in FinTech app development. An application may have to cater to different jurisdictions, with a range of product capabilities, and it may have to go through the process of verifying people’s identities, carrying out anti-money laundering checks, and complying with payment card security standards, and understanding data protection regulations like GDPR. These aspects are not just superficial features that can be added at the end of the development. They are integrated into the system architecture from the beginning.

Requirements for compliance determine data storage, access logging, transaction monitoring, and incident reporting. Stripe is a great example of a company that was able to turn compliance into a long-term strategic asset. By developing internal compliance tools early, Stripe was able to expand internationally faster than its competitors that were relying on fragmented or manual solutions. For start-up products, third-party services often lessen the initial effort; however, integration, customization, and ongoing maintenance are still significant contributors to the overall cost.

Feature Scope and the Cost of an MVP Versus a Scalable Product

The definition of feature scope at the outset by teams is another significant factor affecting costs. Most of the time, quite a few of the startups in the FinTech field think of the existing market leaders and want to have the same features as them right from the start. This typically leads to budget overruns without any improvement in the product-market fit.

The early product path of Revolut is a good example of the more sustainable way of going about it. The first version was designed for the international cards and currency exchange, solving a particular problem for tourists. The company only launched the areas of trading, crypto, insurance, and business banking after it had already validated demand. This staged rollout not only controlled initial costs but also laid the groundwork for future expansion.

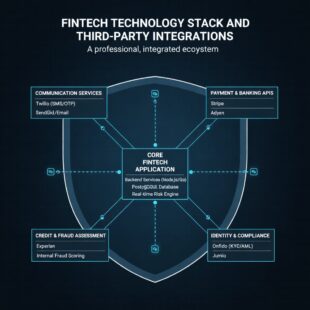

Technology Stack and Third-Party Integrations

FinTech applications are not frequently utilized as independent systems. They depend on various services such as payment processors, banking APIs, identity verification providers, credit bureaus, fraud detection services, and reporting tools. Therefore, every integration brings along development work and risk of dependency for the long term.

The buy-now-pay-later services very clearly show this complexity. Organizations like Klarna and Affirm rely on real-time risk assessment engines capable of transaction evaluations in milliseconds. These systems have to be built and sustained with the help of highly skilled backend staff, extensive testing, and meticulous watching over, even if parts of the reasoning come from external suppliers.

Team Experience and Delivery Model

Hourly rates show large differences depending on the region but the FinTech development sector usually pays more for experience than for the cheapest option. A group that knows nothing about the financial regulations or security measures could lead to the creation of a system with flaws that would eventually cost a lot to fix. Mistakes in regulated sectors are costly, audits are strict and customers lose their confidence in the product very fast if there is a system outage.

That is why the maturity of delivery is often a more important factor than the location. Teams with previous FinTech experience are usually the ones who recognize the regulatory issues first, create the more resilient systems and, as a result, have less likelihood of needing to redo the job.

Realistic Cost Scenarios from the Market

By observing real-life situations, one can better understand what to expect. A home-based early-stage lending startup in the United States generally allocates its budget for flows of onboarding, integrations of credit scoring, logic of loan management, and compliance readiness at a minimum. Such a product is often priced in the low six figures range.

An app for cross-border payments aimed at European users has to overcome a higher obstacle. Requirements for multi-currency support, monitoring of transactions, and very strict data protection have the effect of increasing both the costs of development and compliance. The mentioned factors justify the fact that pretty much alike FinTech apps can have totally different budgets.

Ongoing Costs Beyond Launch

The launch is not the last step in development. Besides that, there are regular costs that include the support of the cloud infrastructure, the payment of third-party services, the performance of security audits, the implementation of updates according to the regulations, and the product enrichment. Actually, maintenance per year is sometimes as high as fifteen to twenty-five percent of the initial development cost.

On the other hand, the very co-founders who neglect this phase in their planning will often face difficulties in maintaining their growth, despite the fact that the first launch has gone well.

Conclusion

No single price tag fits all for the development of a FinTech app. The expenses show the product’s ambition, the exposure to regulation, and the long-term strategy. Winning companies think of the development as an unending investment in trust, security, and resilience instead of a one-time engineering work. This kind of thinking often distinguishes the FinTech products that quickly gather users from those that eventually receive the financial ecosystem’s trust for a long time to come.